Related: The Advantages of Data-Driven Decision-Makingįor example, consider a business that regularly experiences year-over-year revenue growth that’s offset by rising expenses. By understanding those goals, you can prepare a budget that aligns with and facilitates them. Understand Your Organization’s Goalsīefore you compile your budget, it’s important to have a firm understanding of the goals your organization is working toward in the period covered by it. The steps below can be followed whether creating a budget for a project, initiative, department, or entire organization. Steps to Prepare a Budget for Your Organization Instead of thinking of the two documents as competing, view them as complementary, with each playing a role in driving your business’s performance. The cash flow statement plays a different role by offering a higher-level overview of how money moves into, throughout, and out of an organization. Second, a budget is, quite literally, a tool used to direct work done within an organization. Related: The Beginner’s Guide to Reading & Understanding Financial Statements This provides greater context for making tactical business decisions, such as considering where to trim business expenses. Yet, they differ in key ways.įirst, a budget typically offers more granular details about how money is spent than a cash flow statement does. If the definition above sounds similar to a cash flow statement, you’re right: Your organization’s budget and cash flow statement are similar in that they both monitor the flow of money into and out of your business. This allows an organization to understand where it went wrong in the budgeting process and adjust estimates moving forward. Most organizations also prepare what’s known as an “actual budget” or “actual report” to compare estimates against reality following the period covered by the budget.

#When creating a budget log fixed expenses free

For this reason, organizations often create both short- (monthly or quarterly) and long-term (annual) budgets, where the short-term budget is regularly adjusted to ensure the long-term budget stays on track.įree E-Book: A Manager's Guide to Finance & AccountingĪccess your free e-book today. Income is based on projections and estimates for the periods they cover, as are expenses. What Is a Budget?Ī budget is a document businesses use to track income and expenses in a detailed enough way to make operational decisions.īudgets are typically forward-looking in nature. For this reason, the ability to prepare a budget is one of the most crucial skills for any business leader-whether a current or aspiring entrepreneur, executive, functional lead, or manager.īefore preparing your first organizational budget, it’s important to understand what goes into a budget and the key steps involved in creating one. Your income and expenses may change over time, so it's important to stay on top of your budget to ensure you are staying on track.īy following these tips, you can create a realistic budget that allows you to reach your financial goals without feeling restricted.An organization’s budget dictates how it leverages capital to work toward goals. Review your budget frequently and make adjustments as necessary. It's okay to treat yourself every once in a while, just make sure you are budgeting for those treats in advance. It's also important to remember that budgeting is not restrictive, it's about balance. Instead, set a goal to pay extra towards your student loans each month.

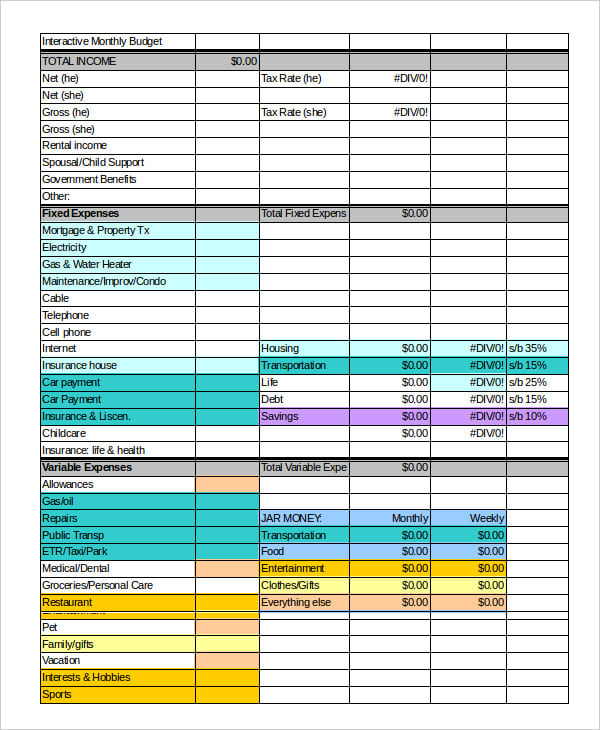

For example, if you have a large student loan payment each month, it may be unrealistic to set a goal to save a certain amount of money each month. Once you have a clear picture of your income and expenses, you can begin to set realistic goals for yourself. These expenses can vary each month, so it's important to have a good estimate of what you typically spend in these areas. Then, make a list of your variable expenses, such as groceries, gas, and entertainment. Next, create a list of all of your fixed expenses, such as rent or mortgage payments, car payments, insurance, and other bills that are the same amount each month. This includes your salary, any overtime pay, bonuses, and any other forms of income you may receive. Start by identifying your income sources. Here are a few tips to help you approach the process with ease and success: Creating a realistic budget as a nurse in 2023 can be a challenging task, but it doesn't have to be overwhelming.

0 kommentar(er)

0 kommentar(er)